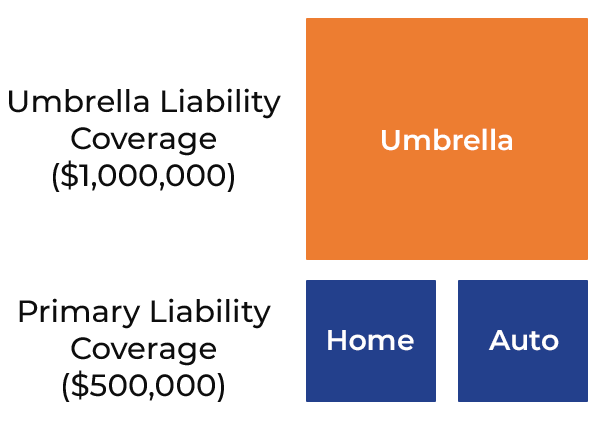

Umbrella insurance provides additional coverage that kicks in when the liability limits on your home or auto insurance have been reached. It can protect you from major claims and lawsuits, covering damages like injuries, property damage, and legal fees that exceed your standard policy limits.

Why You Should Have Extra Protection

Accidents happen in the blink of an eye. A momentary distraction while driving or an injury on your property could lead to a serious lawsuit. Whether you're facing medical bills, legal fees, or settlements, umbrella insurance ensures you’re not left to cover these costs alone.

Remember, your home and auto policies offer coverage per accident, not per person. For example, a $500,000 limit applies whether one person or multiple people are injured. An umbrella policy extends that coverage, protecting you against larger claims.

How Much Umbrella Coverage Do You Need?

To determine the right amount of umbrella coverage, consider your family’s assets—your home, personal belongings, investments, and future earning potential. Ask yourself “How much do we stand to lose in a worst-case scenario lawsuit?” The good news is that umbrella coverage is affordable and higher limits are readily available.

At MetzWood, we’ll help you evaluate your unique situation to ensure you’re fully protected.

Disclaimer - This article is for general illustrative purposes only. Exact terms and conditions will be set forth by the policy contract and coverage may be different than indicated here.